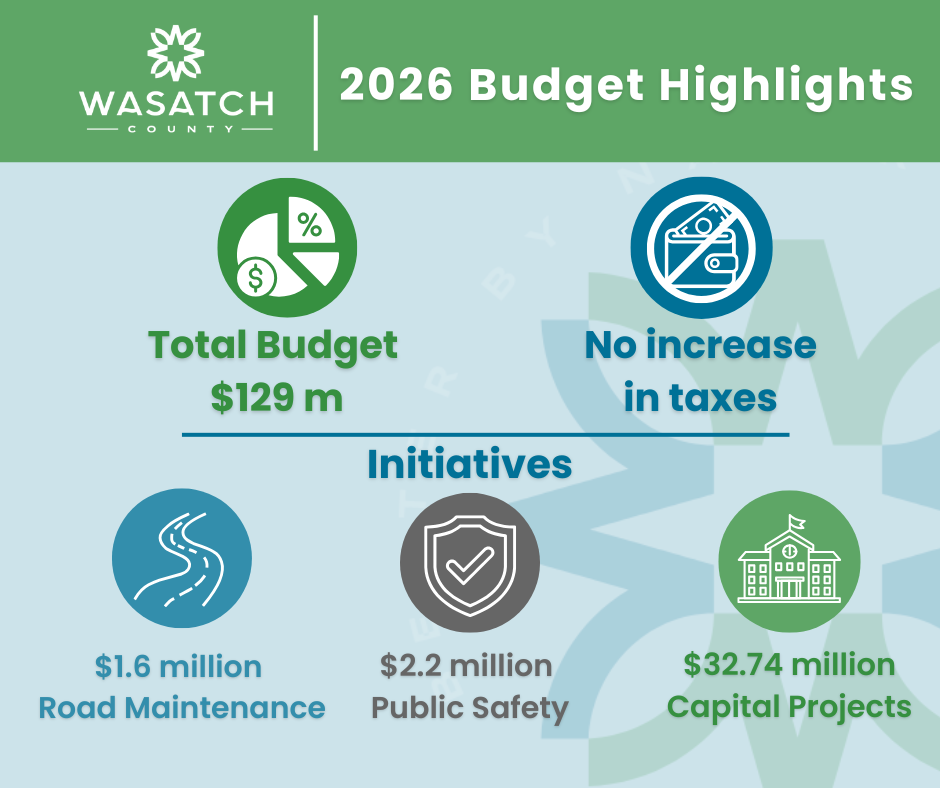

2026 Approved Budget provides balanced services without raising taxes.

In line with the council's strategic long-term priorities, Wasatch County has structured the 2026 budget to meet community needs without requesting a tax increase for the second year in a row.

Long-term Strategic Priorities

- Remain fiscally conservative.

- Be a high-performing county with a highly trained workforce.

- Prepare for future anticipated growth.

- Provide balanced service levels that improve quality of life.

- Maintain rural character and preserve open space.

Wasatch County is able to maintain and, in some cases, expand levels of service, by strategically using revenue from all 25 available funds to avoid the need to ask taxpayers for additional revenue. For example, by transferring funds from the transient room tax fund, Wasatch County was able to fund the majority of Wasatch County Parks and Recreation Special Service District budget requests without requesting additional revenue through Truth in Taxation for 2026.

Then Why Did My Property Taxes Change?

If you have seen changes in your property tax amount or rates in the past two years, these variations are due to either adjustments made by other taxing entities, such as municipalities, emergency services, the school district, or special service districts, or by the Utah State Tax Commission.

Property Tax Distribution

Utah law requires counties to collect a set amount of property tax revenue each year, not to keep the tax rate fixed. When the total value of properties in the county rises, the tax rate drops, keeping revenue the same. When property values drop, the tax rate increases to collect the needed revenue.

This system ensures that counties continue to receive stable funding, even when property values change due to market conditions.

The Utah State Tax Commission provides oversight to enforce consistent practices across the state.

The Foundation: $52 million General Fund

The General Fund budget, or base budget, outlines how revenues are allocated to essential services and infrastructure. For 2026, the General Fund totals $52 million and includes revenues from sources such as permits and fees, property taxes, grants, and transfers from other funds.

Key investments from the general fund in the 2026 budget include infrastructure improvements to Snake Creek Road and flood control measures with the completion of the Lake Creek debris basin and splitter. The county will also finish the courthouse expansion project and begin construction on a new administration building. At the same time, Wasatch County is investing in current staff and adding positions to improve service levels.

- Seven positions in the sheriff’s office, including a professional standards director, two dispatchers, one patrol officer, one school resource officer, and two bailiffs.

- A building inspector and a permit technician to support continued growth in residential and commercial development. The cost of these positions is expected to be offset by the anticipated increase in development-related fees and permits.

- A road maintenance position

- A facility maintenance position to support the courthouse expansion.

- A civil attorney

Investing in the Safety of Our Community

As Wasatch County grows, so does its commitment to public safety. The 2026 budget allocates $2.2 million in public safety initiatives. This funding will support new positions in the Sheriff's Office, jail facility safety improvements, and provide matching funds for a grant to purchase a new dispatch console system, along with a $169,000 transfer from the General Fund to the General Use Capital Improvement Fund to help fund future public safety capital projects.

Pavement Maintenance to Save Future Costs

Wasatch County currently maintains 327 miles of Class B roads, with a recent inventory showing an average remaining service life of 14.66 years.

The county’s pavement maintenance goals are to keep an average remaining service life of over 10 years and ensure that no more than 3% of Wasatch County roads have a remaining service life of 1 to 2 years.

To meet these goals, the 2026 budget includes a recurring $750,000 transfer from the Transportation Fund, bringing the pavement maintenance budget to $1.6 million this year.

Prioritizing pavement maintenance helps the county avoid costly rehabilitation or reconstruction projects. Reconstructing one mile of road could instead fund preventative maintenance for 20 miles or routine maintenance for 85 miles.

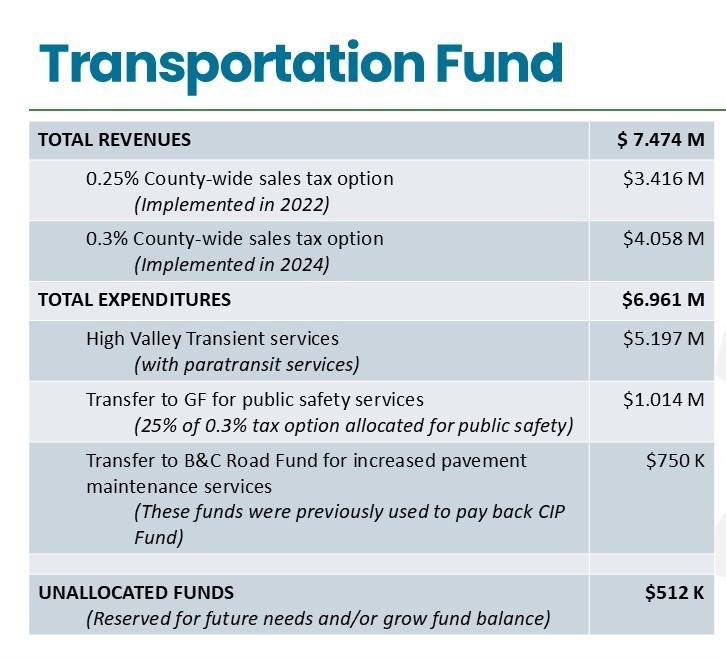

Transportation Fund

The 2026 budget includes funding paratransit, micro transit, and a fixed-route bus service with unchanged service levels for the upcoming year.

In 2024, the County Council adopted the 0.3% tax option, 25% of which is allocated toward public safety.

Planning Ahead: Courthouse, Jail, and New Administration Building

Looking ahead, Wasatch County is investing in capital projects that will benefit the community for decades. The courthouse expansion project is currently under budget and scheduled for completion in 2026, along with renovations to portions of the county jail to improve safety.

In 2026, the county will begin construction on a new administration building, using existing revenue sources. No tax increase will be required.

The balanced approach to the Wasatch County budget ensures that services keep up with the growing community and improve quality of life, while remaining fiscally conservative and protecting the values that make our community unique.